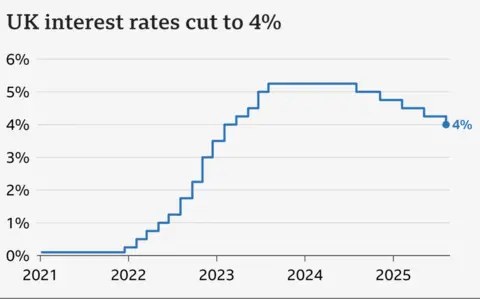

Bank of England Big Announcement: On Thursday, September 18th, the Bank of England (BoE) will once again capture the attention of investors, homeowners, and economists worldwide. On this day, the Bank’s Monetary Policy Committee (MPC) will deliver its latest decision, and it is widely expected that interest rates will remain steady at 4%. This decision will have a profound impact on the direction of the British economy and the pockets of ordinary people.

Why might the pace slow down after the August rate cut?

In August, the MPC reduced the Bank Rate from 4.25% to 4%, the lowest level in more than two years. This move was seen as an attempt to boost the economy. However, recent economic data suggests that the Bank may not make any further rate cuts for the rest of this year. The main reason for this is persistent inflation.

Official data released on Wednesday has increased concerns. Rising food prices pushed inflation to 3.8% in August, nearly double the Bank’s 2% target. Interest rates are the BoE’s most important tool for controlling inflation. In theory, higher borrowing costs reduce people’s spending power, thereby curbing prices. However, excessively high rates can also slow the economy.

What does the MPC vote say?

The decision to cut interest rates in August was not easy. It was made possible only after an unprecedented second vote among the nine MPC members. Bank Governor Andrew Bailey described the decision as “completely balanced.” This time, analysts believe the vote will be more clear-cut, with no change in rates. High inflation poses a significant challenge for policymakers, and they will not want to take any action that could further increase it.

What will be the impact on your mortgage and savings?

The Bank Rate directly impacts the lives of ordinary people. When someone takes out a new fixed-rate mortgage, the interest rate they receive is influenced by the Bank Rate. Lenders use this to determine their rates. Expectations of a fall in interest rates can lead to a decrease in mortgage rates, while expectations of a rise can lead to an increase.

Despite the August rate cut, mortgage rates have not yet fallen significantly. According to Rachel Springall of Moneyfacts, the future direction is uncertain. She says that given forecasts of inflation remaining above target, further cuts this year are unlikely.

On the other hand, this is a time for savers to be cautious. Falling interest rates also mean lower returns on savings accounts. Springall explains, “The average easy-access savings rate has fallen below 3%. Savers should act immediately and change their variable rate account if it is not providing a good return.”

Global Context: What’s happening around the world?

The British government will likely want to further reduce interest rates to boost economic growth. Think-tanks like the Resolution Foundation say there’s a dire need to improve living standards after 20 years of “lost” growth. However, ministers are also aware that inflation risks remain, especially as inflation is slowing in countries like the US, Germany, and France.

The BoE’s decision follows the latest moves by the US Federal Reserve, which on Wednesday cut rates for the first time since December, from 4% to 4.25%. Last Thursday, the European Central Bank also decided to keep its interest rates at 2%.